hello everyone hi welcome to the channel of Wallstreetmojo friends today

we are going to learn a concept that is on MD&A that is management discussion

and analysis over here we are going to discussed a few of the examples also so

let's get in to integrity of the same the first and the foremost thing

as you can see over here is Colgate-Palmolive companies table of contents

there are many of the things like business risk factors and so on and so

forth but we have to look at the item number seven which shows us as

management discussion and analysis of financial conditions and result of the

operations so they were for the very first in the foremost stage what is MD&A

see the annual report of any company when he listed company or as listed by

Colgate contains a separate section by the name as known as MD&A and a that is

management discussion and analysis see the MD&A section includes various topics

that includes like macro economics you have macroeconomic performance of the

industry the company's vision and then you have your strategy and some key

financial indication and so on and so forth so as an investor that is very

very insightful information provided by the company to the correlate of

macroeconomic parameter and the performance of the company and so on and

so forth of the company in light of them so the section containing the MD&A is

included in the company's annual report and you can say in addition to a similar

section analyzing the company's financial performance and decoding of

the financial ratios and various indicators of the for the investors so

management discussion and analysis one of is one of the most useful sections

for the financial analysis so let's get into the detail the first in the

foremost thing what is the difference between MD&A and the audited financials

so as for SEC an independent accounting firm should perform an annual

audit of the company's financial statement and provide an opening on the

material misrepresentation

however auditors are not required to audit the management discussion and

analysis this it is not to be done but yes this is to be done the audited

financial so they are not required to order

the management discussion analysis section MD&A section is basically an SEC

filing and are the opinion of the management about the company's financial

and business health and provides detail of its future operations

so what detail must you look in MD&A as simple as that see the corporate world have

adopted the MD&A and basically you can say that you know the route to

demonstrate their commitment to the company's vision and strategy so how the

management has created the value and delivered performance in light of that

long-term goals so when the term management is referred throughout is

throughout this topic it will be involving complete structure there'll be

a complete structure here in case of the organization including the Board of

Directors you have CEOs in all the Chiefs involved in the same and the

reporting officers that they're basically reporting officers controllers

and so on and so forth the human resource department finance marketing

production operation and remaining middle and lower management levels so

hence MD&A it is not only to dissects financial figures and results but also

looks into the human resource and operation is this side of the business

which the fundamental and the key factors to any business organization is

the first of the foremost thing is MD&A1 that is the execution overview and

outlook see executive overview that is the next one that is what we are

studying is we are going to discuss as executive executive and overview and

outlook okay so executive overview outlook section focuses on details of the

business number of segments it has the geographies and they they operate it all

supports detail on the focus areas of management and how they look forward to

achieving the business and financial objectives now this is your executive

overview and outlook how this has been written operationally the company's

organized along with the geographical lines and management teams they have

approximately 75% of the company's net sales are generated from the market

outside India so geography has been different it has been discussed 50

percent the company's net you can see sales coming from the emerging markets

from this areas in the geography diversity and balance helps to reduce

company's exposure to business and other risk in wind in any country or the part

of the world so this is the executive our overview and outlook see

Colgate uses variety of the indicators to measure the business health and this

include the market shares net sales organic growth profit margins gaap and

non gaap income cash flows and return on capital

so Colgate also notes that you know it expects global you can say

macroeconomics and market condition to remain highly challenging in category

growth rates continuing to be very slow the second thing that we are going to

discuss over here the discussion on the results so you can see discussion on

results of operations now in this section the company discusses the key

highlights of the current financial or the current fiscal period financial

performance in this basically management provides details of net sales gross

margins selling in general admin cost income taxes and so on and so forth also

basically provide the details of any dividend declared and its payment that

is the payment details are as follow we can see from the following

table see as you can see over here this is the details regarding the result of

the operations net sales was this it was down by 5% then internet selling price

increase by 2.5 and there all of the details are regarding you know the

volume has increased by 1.5% and so on and so forth so they called

Colgate's net sells is down over here by 5% in 2016 as compared to 2015

due to the volume decline of 3% close enough to 3% and negative

foreign exchange impact of close enough to 4.5% the colgate notes to the

organic sales of oral personal and home care ok a product segment increased by

around $4 basically in 2016 let's see some of the discussion on the segment

results see the company also provides you to detail on the individual segments

it contribution to the overall sales growth rates and the performance measure

let's see that you can see the segment details over here the company markets

its product over here they call Colgate operates in close enough to 200

countries with primarily two segments that is the oral and the personal and

home care and the pet nutrition segment so this is how the details has

been divided of oral postal and the home care situation in North America the

fourth thing that we are going to see over here let me write over here the

third was what we saw is the segment that is discussion on the segment

results so I'll just write over here segments now the next is the discussion

that we are going to do on non-gaap financial measure just right over here

non-gaap financial measures see generally what happens is that you know

the company uses non-gaap measures for the internal and budgeting segments

evaluation evaluation and understanding over performances so therefore the

management shares the information with the shareholders so that they can get a

better insight into the financial performance of the company as you can

see over here this table provides a quantitative reconciliation of net sales

grow to the organic sales growth for each of the year of 2016 and 15 there

are there are details of Personal and home care data over here offer and the

organic sales growth so the about table towards a reconciliation of net sales

growth of gaap to the non-gaap okay measure of the Colgate's the next step

we are going to discuss is the liquidity and the capital I'll just write for you

liquidity and cap capital resources okay so now this section provides you the

detail of the cash flow rate in issuances that will help you to meet the

business operating and recurring cash needs

so you can see the liquidity in the capital resources and the cash flow

details over here the over here we can see that the Colgate generated close

enough to 3141 in 2016 and it's cash flow that was their cash flow

from the operations and its cash flow from the investing activity was close

enough to $499 and then after additionally the cash flow

from the financing activity was then was an out go of 2,233 in

2016 so additionally the long-term debt including the current portion of

the debt decreased to close enough to 6520 in 2016 the next thing

of management discussion and analysis the sixth point that is the off-balance

sheet arrangement off balance sheet arrangement now in this scenario this

section provides you the details of of any balance sheet financial arrangement

if the company has entered into like you know the company does not have any

off-balance sheet if it is usual it is everything that you know the company

does not have any off-balance sheet financing or uncommon solicited special

purpose entities so colgate does not have basically any off balance sheet

financial financing arrangement the seventh point of management discussion

analysis in this section is managing your foreign currency so that is your

next item is foreign currency interest rate commodity pricing and credit risk

exposure so in this section the company discloses how it manages its currency

risk interest rate risks and the price fluctuation so managing the foreign

currency you know let's let's see basically how the details go about

as you can see over here this is how the details has been disclosed for managing

foreign currency interest rate commodity pricing and credit risk exposure

now the colgate manages its foreign currency exposure through cost

containment measures sourcing strategies selling price increases and the hedging

of certain cost to minimize the impact of the earning of the foreign currency

rate moments second the company manages over here its mix mix of fixed and

floating rate of debt against its target with the debt issuance and by entering

into interest rate swaps in order to mitigate the fluctuation in the earning

of the cash flow and you can say that may result from the interest rate

volatility the third is futures contracts are used in on a limited basis

to manage the volatility related to anticipated raw material inventory

purchase of the commodity now the eighth one the eighth is basically the critical

accounting policies so I'll just write accounting policies over here in case of

the accounting policies in this section the company management discussion and

critical accounting policies that have meaningful impact on the financial

representation of the company's health now this is how the things go about for

the same the shipping and the handling drawers may be reported either a

component of the cost sales over here the company accounts for inventor using

the FIFO method and 75% of the invent of 70% of the inventory and LIFO for

20-25% as it is so we need from the we note from the about that Colgate

uses both FIFO and LIFO method for the inventory valuation and from the

above-mentioned details a fair idea can be taken as to what kind of information

disclosures today's corporate world is required to make to make an accountable

to the investors community and society at large as well as the transparency in

the reporting since the management is well positioned then the stakeholders

who are the outsider to provide information regarding the performance of

the company based on such management's analysis only certain presence actions

taken by the company can be justified and a walk towards the committed goal

can be demonstrated by the management now the next in the for thing is how

does the MD&A help see MD&A helps in understanding the operations basically

and look at the next sheep so MD&A helps in understanding the operations and

financial results in a better light MD&A has a certain definite objective which

can be as follow like you know the first one is like you know in it enables the

readers of the financial statement to understand it in better ways of number

in numbers financial conditions and to get into management shoes to understand

certain strategic and operational decision which are bold and largely

impacting the future performance and position of the company so basically you

can say the understanding portion is really a great sense over here

understanding the second is additional supplementary and complementary

information provided in MD&A and a will help the readers understand what exactly

the financial statement that will depict here and what is not reflected the third

is you can say that you know the addressing the investor perception

towards the risk associated with the business operations and outline the past

tends to indicate the management efforts towards mitigating those risks and

leading the path towards the future financial statement now what is the

format and the extent of the information that MD&A should reveal so for the same

there are really details that we should evaluate the first and the foremost

thing over here is that you know you can note from the dimension objectives you

know that we have discussed over here and the governing regulations in India

there is a prescribed and constantly followed practice of how the information

is presented in the annual report however neither is there any

comprehensive reporting format prescribed by the government in this

regard and nor can we notice any universal practice that has been there

for the same so the accounting professionals and the governing

institution acting in respect of the countries might provide guidance for the

presentation of MD&A like for example FASB that is the financial

accounting standard Authority advisory board okay FASAB in the United States

has issued a recommended accounting standards on the management discussion

and analysis with the first draft by publishing in January 1997 which can be

accessed using the FASAB standard on MD&A in India so in India basically there

is no standard or guidance note in this

behalf however there is a company called ICSI that is Institute of the Institute

of the Company Secretaries of India has issued a reference note on the boards

report under the Companies Act 2013 series but leaving MD&A

presentation to the interpretation of the industry say taking note from the

another prominent institution guidance on management discussion and analysis

you know the Canadian performance reporting board has laid down certain

principles based on MD&A and should be prepared those principle are like you

know the first one is like through the eyes of the management as this right

over here through the eyes of management now in this case what happens is that I

know the company should disclose information in the MD&A that enables the

readers to view it through the eyes of the management second is integration

with the financial statement MD&A should be complemented as well as the

supplement of the financial statement you can see a third is completeness and

you can say materiality and materiality case materiality see in this case the

MD&A should be balanced complete and fair fair as well as the provided

information that is material to the decision-making needs of the users FASAB

has described the requirement in other words saying that MD&A should

deal with the vital few methods there are some of these strategic perspective

also like you know the MD&A should explain management strategy for

achieving the short-term and long-term objective the the fifth one is the

usefulness to be useful MD&A should understand the relevant comparative or

comparable verifiably verifiable and timely so conclusion in conclusion in

the light of the increased participation of the retail as well as the foreign

investors in the capital market in the recent years a more comprehensive and

transparent mechanism of information dissemination is always required so this

is because MD&A basically you can say must provide insightful and

sufficient information to the stakeholders community to analyze

companies based on the performance and help better mobilization of capital this

is more required in India especially after the economic survey of close

enough to in 2017 which depicts that India has beckoning sweet spot in the

darkness of the world economic MD&A is being one

of the very efficient way to provide meaningful and a highly useful

information to the investors and improvement any in MD&A and in

presentation format will lead to a good corporate governance that is your CG and

practices and a healthy relationship between the companies and the investors

community

For more infomation >> How much is it to travel to Japan? Foreigners give their tips - Duration: 11:14.

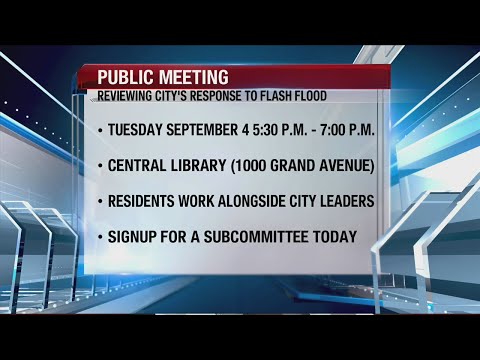

For more infomation >> How much is it to travel to Japan? Foreigners give their tips - Duration: 11:14.  For more infomation >> The city of Des Moines is looking for your input on their performance - Duration: 2:29.

For more infomation >> The city of Des Moines is looking for your input on their performance - Duration: 2:29.

For more infomation >> Dillard's is hosting a luxury vintage pre-owned handbag event in September - Duration: 3:30.

For more infomation >> Dillard's is hosting a luxury vintage pre-owned handbag event in September - Duration: 3:30.

For more infomation >> Today is KOAA Day at the Colorado State Fair - Duration: 2:42.

For more infomation >> Today is KOAA Day at the Colorado State Fair - Duration: 2:42.  For more infomation >> Today is KOAA Day at the Colorado State Fair - Duration: 3:15.

For more infomation >> Today is KOAA Day at the Colorado State Fair - Duration: 3:15.

Không có nhận xét nào:

Đăng nhận xét