Okay, everybody, thanks for attending the webinar here, Emergency Strategies for Stopping

Collection.

My name is Dan Pilla, I'm a tax litigation consultant, and author of 14 books on dealing

with the IRS, and I've got over 40 years of experience in handling IRS problems of every

description.

About 80% of the work that I do is collection defense work, and so we're going to start

right in with exactly how collection begins.

I want to show you exactly what you can expect from the IRS when you've got a client that

owes taxes, and we're going to talk about old debts, we're going to talk about new debts.

Let's start with the new debts, how collection begins with new debts.

What happens is before the IRS can levy any kind of assets, before they can touch a nickels

worth of your clients assets, the IRS has to send a final Notice of Intent to Levy.

Now this is a very important notice because there are critical rights that attached to

the receipt of this letter, and I want to explain what these final notices look like.

There's actually three different versions, because you can't expect the IRS to do things

easily or simply, they got to have three versions of the same letter.

The first letter is called a letter 1058.

That's letter 1-0-5-8, and it's entitled Final Notice of Intent to Levy, and Notice of Your

Right to a Hearing.

You identify letter 1058 by the lower right margin, the letter number is in the lower

right margin.

This letter is unlike the computer notices that the IRS mails out from the service center.

Those notices our so-called CP notices, we'll talk about those in just a minute.

But the final notice letter looks like actually somebody sat down at their computer, and actually

typed out a letter address to your clients.

So that's the letter 1058.

The second version of this letter is called the letter CP90.

Now this does look like some of the computer notices that the IRS mails out from the service

center.

But when you read it carefully, it is also identified as a Final Notice of Intent to

Levy, and Notice of Your Right to a Hearing.

You identify the CP90 in the upper right corner of the notice.

It'll say notice number, and that's where you get your CP90 from.

The third version, and this is probably the most common version of all, is the LT 11.

It looks, for all the world, just like the CP90.

But of course, it's got a different identifying number that being the LT11.

You first want to make sure what you're dealing with when you're receiving computer notices.

Too many people do not understand what the notices are that they're getting.

The final notice letter only takes the form of one of these three letters that we've just

identified.

Letter 1058, letter CP90, or the LT11.

No other notice that the IRS mails out is a Final Notice of Intent to Levy and Notice

of Your Right to a Hearing.

It's critical to understand this letter because you've got important rights that grow from

these notices.

Now, I want to talk for just a second about what these- what a final notice is not.

A final notice is not any of the other CP notices the IRS mails out.

A CP501, CP503, CP504, these are all various collection letters, but they're not a final

notice letter.

The IRS cannot levy a bank account, a paycheck, any assets whatsoever until they mail this

Final Notice of Intent to Levy and Notice of Your Right to a Hearing, and this is critical.

Now, there is an exception to the CP notice thing, and it's CP523.

I want you to make a margin note here about CP523.

This is a notice that an installment agreement has been rejected, and the IRS can levy after

30 days of sending out a CP523.

Now this is important, and so I'm going to spend some time on it later in the conference

here, so you understand exactly how that works.

Collection begins when this final notice is sent out, the final notice gives you 30 days

to file a collection due process appeal.

Now, I want you to understand something very important, and this is a mistake that a lot

of people make.

Taxpayers make this mistake all the time, and sometimes tax professionals make this

mistake as well.

So I want you pay attention to this.

You cannot get an extension of the 30 day period of time on the final notice letter.

That 30 day period of time to file, what's called a collection new process appeal, is

statutory.

There is no exception to that.

And so if you call the IRS, and say, "Well, we can't pay in 30 days.

Can we get an extension?"

They'll give you an extension on payment that's true, but you will not get an extension on

your ability to file a collection due process hearing.

That 30 days is hard and fast and cannot be extended.

Now, the reason it is important to submit a collection due process appeal is because

this does two remarkable things for you.

First of all, it stops all collection in its tracks.

The IRS is automatically shut down from levying or seizing anything as long as you file that

collection due process appeal within the 30 day window, so that's number one.

It's an injunction against the IRS from collecting.

Number two, as it moves the case to the IRS's Office of Appeals.

You take the case out of the hands of the collection function, you put it into the hands

of the appeals function, and the written job description in this context now is to negotiate

a settlement with the IRS.

Their function, the Appeals Office function is to entertain what are called collection

alternatives, and to give you an opportunity to propose, for example, an installment agreement,

or an offer and compromise, or perhaps uncollectible status, or any such thing as that.

Perhaps you can get some penalties canceled, any of those kinds of combinations of things

that are available.

Another important thing is when you file this appeal in a timely manner, you've got the

right to a Tax Court appeal if you can't come to terms with the Appeals Office.

It's a judicial appeal through the Tax Court which is very, very important, because you've

got that leverage, the IRS is forced to consider your arguments carefully and to do the right

thing when it comes to applying the law and the facts.

This is a very, very powerful tool that you need to know about.

In order to execute this collection due process appeal, you have to file IRS form 12153, it's

called a Request for a Collection Due Process or Equivalent Hearing.

That is the form that commences the collection due process appeal.

That form is filed within 30 days of the date of the final notice letter, and that kicks

things off as far as your appeal is concerned.

So now, what happens if your client missed the 30 day deadline?

Very often, what happens is clients come into my office, and they've got a shoe box full

of unopened envelope from the IRS that they've been collecting.

It's only when their paycheck gets hit or their bank account gets levied that they actually

get jolted into action.

In that situation, they have blown their 30 day deadline, they do not have the opportunity

for a collection due process appeal.

However, there's a second appeal that's available, and that appeal is called an Equivalent Hearing,

you use the same form, form 12153, you submit that form, and that form can be filed within

one year of the final notice date.

This is the secondary appeal process.

First one is called Collection Due Process.

This one is called a Request for an Equivalent Hearing.

It's filed within one year of the final notice letter.

This will also kick your case into the Appeals Office where you've got an opportunity to

sit down with an appeals officer and propose collection alternatives.

The problem with the Equivalent Hearing, and this can be a significant downside to having

missed that 30 day deadline, is you do not have a Tax Court appeal right when it comes

to further challenging the decision of the Appeals Office.

Appeals Office decisions in these Equivalent Hearing cases are final, they're not subject

to judicial review.

And so that's an important limitation.

However, the upside is that the IRS will very often, unless there's some reason for it to

believe that there's abuse, or that this is done solely for the purposes of delay, the

IRS will often stop collection while an Equivalent Hearing is pending.

That gives you an opportunity to propose collection alternatives without having the negative impact

of levies and seizures going on while you're doing that.

For more infomation >> Government shutdown reaches day seven as Trump continues to push for border wall funding - Duration: 3:14.

For more infomation >> Government shutdown reaches day seven as Trump continues to push for border wall funding - Duration: 3:14.

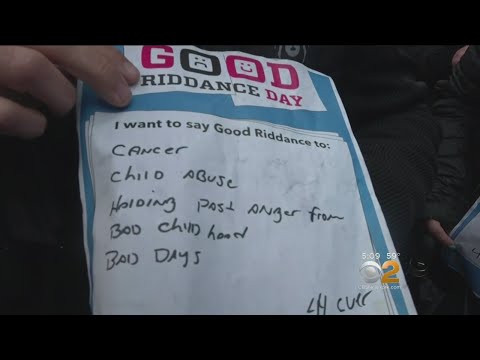

For more infomation >> New Yorkers Say 'Sayonara' To Bad Memories For Good Riddance Day - Duration: 1:48.

For more infomation >> New Yorkers Say 'Sayonara' To Bad Memories For Good Riddance Day - Duration: 1:48.

For more infomation >> Blood donors needed for start of 2019 - Duration: 2:18.

For more infomation >> Blood donors needed for start of 2019 - Duration: 2:18.

For more infomation >> Snapchat rolls out filters for your dog - Duration: 0:30.

For more infomation >> Snapchat rolls out filters for your dog - Duration: 0:30.  For more infomation >> Will L.A. Mayor Garcetti Run for President? - Duration: 5:41.

For more infomation >> Will L.A. Mayor Garcetti Run for President? - Duration: 5:41.  For more infomation >> Funeral home provides free services for veterans - Duration: 2:54.

For more infomation >> Funeral home provides free services for veterans - Duration: 2:54.  For more infomation >> Harris County treasurer's plea for state takeover of school district goes awry - Duration: 2:20.

For more infomation >> Harris County treasurer's plea for state takeover of school district goes awry - Duration: 2:20.

Không có nhận xét nào:

Đăng nhận xét